Blog

- Details

- Hits: 2614

What are the top moving home questions according to Google?

Great advice when moving home in Surrey

Stress is something that is a given when you are moving home, so the more information you have

the easier and calmer it can be. There are many places you can ask for advice from experts – friends

who have moved, estate agents, removal companies, and Google! Barratt Homes were curious what

moving home questions home movers have asked Google; can you guess what was the top searched

question?

145,200 Google searches

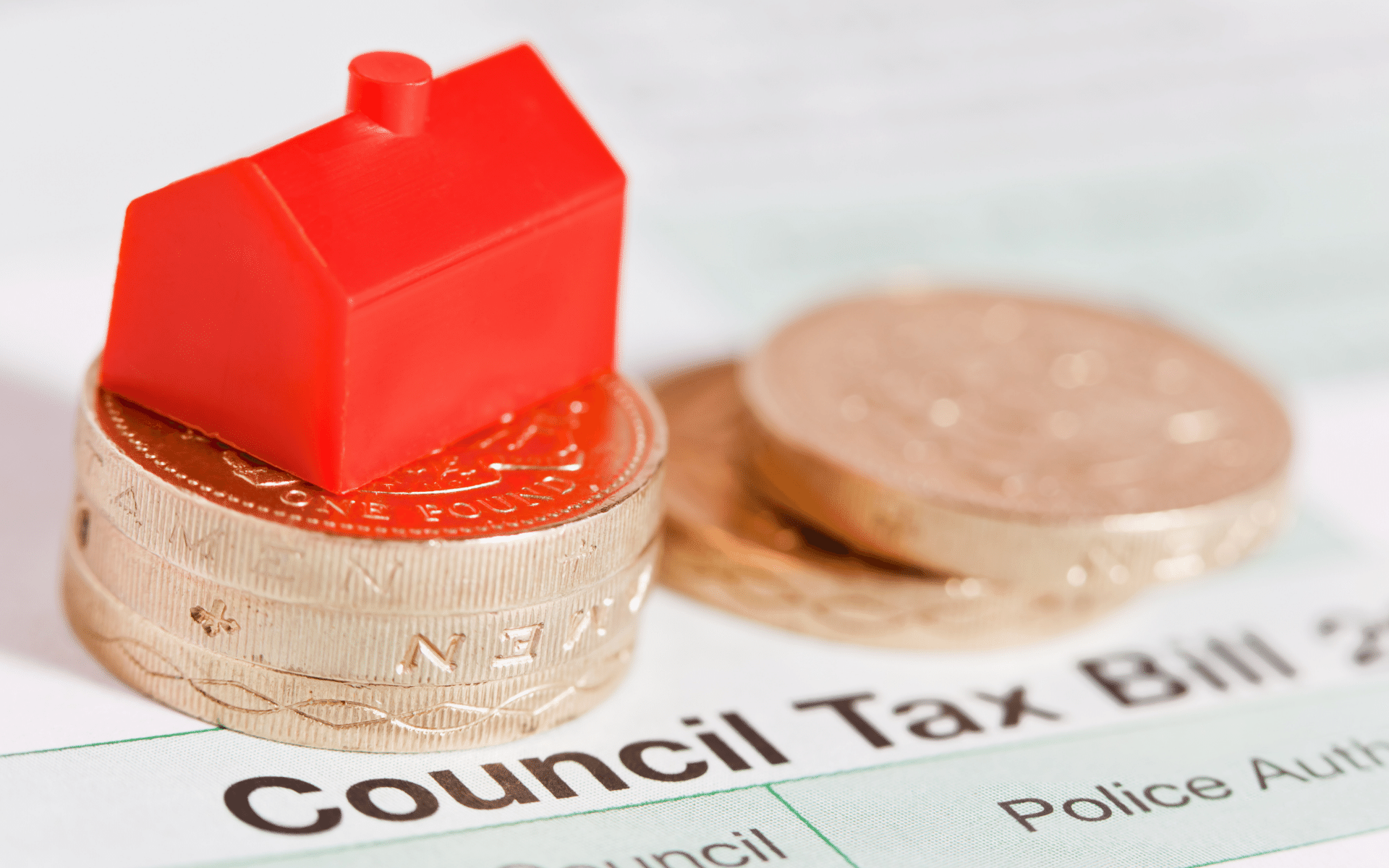

When it comes to the top question home movers asked Google in 2021 the answer may surprise

you, but there were 145,200 Google searches regarding Council Tax when moving house. Council Tax

is an additional expense which can add a lot to your monthly bills, and the amount you pay is based

on the area or ‘band’ in which you live and what your local council charges. You can find this

information on the gov.uk website by entering your postcode.

But things are about to change?

As estate agents, under current legislation in the Consumer Protection from Unfair Trading

Regulations 2008, we are legally obliged to not exclude what is classed as ‘material information’ on

our property listings. If you have been looking for a new home you will have seen that not all estate

agents supply comprehensive details on a property listing, making things a little inconsistent. As part

of a series of changes, Trading Standards and the government have jointly announced the first

compulsory new data which must appear on property listings from the end of May, and this includes

stating the Council Tax band and rate. Now you no longer need to ask Google!

Who should you inform?

One of the most painstaking tasks that you will undertake is to inform everyone and everything of

your new address, from banks to insurance, to utilities and internet providers. There were 12,000

searches last year on this subject, and we can understand why; with so many things happening it can

be easy to overlook a company or organisation. One of the best tips we can give you at James Neave Estate Agents

is to start to make a list well in advance of your move. Go through your monthly bank

statements, check your post and add your subscriptions; having a list ready to go before things get

hectic will only make your life easier as you are settling into your new abode.

How to pack

One of the surprising questions to make the list, with 7080 searches, was how to pack when moving

house. When it comes to packing for your move, you can never start too early, especially if you are

looking for a less stressful move. We have asked our team about their advice for packing when

moving home, sorry Google!

“There will be items in your home that you will not need before your move. Take a drawer, cupboard

or a room at a time and pack away those things you won’t need before your move, get rid of the

things you will never use again, and just leave those handy items behind that you are going to need

in the coming weeks,” said Andy.

Ryan suggests packing seasonally, “Summer is on its way, and we are going to start

enjoying a milder climate; pack away items that you only use in the winter months, such as clothes,

home accessories, and sledges”.

Containing cats

With us being a country of animal lovers, we were not surprised that home movers had questions on

how best to look after their pets during this unsettling time. How long to keep a cat indoors after

moving house was one of the favourite Google questions by home movers. Just as it takes us time to

adjust to a new home and neighbourhood, the same can be said for our pets, including cats as you

don’t want them to try to return to their old home which is familiar. The RSPCA advises that after

moving you should keep your cat indoors for at least two weeks, to help ensure they are settled in

your new house before you let them outside.

Any questions

We know you may have numerous questions when you are looking to move home, starting with how

you begin, to what happens after you have got your keys. No matter where in the process you are,

when you move with us at James Neave we will make sure that none of your questions go

unanswered. You don’t need Google to know which estate agent you want by your side when you

decide to move home, so why not give us a call today on 01932 221331.

- Details

- Hits: 2449

Why you should not neglect your garden when selling your home this spring in Surrey

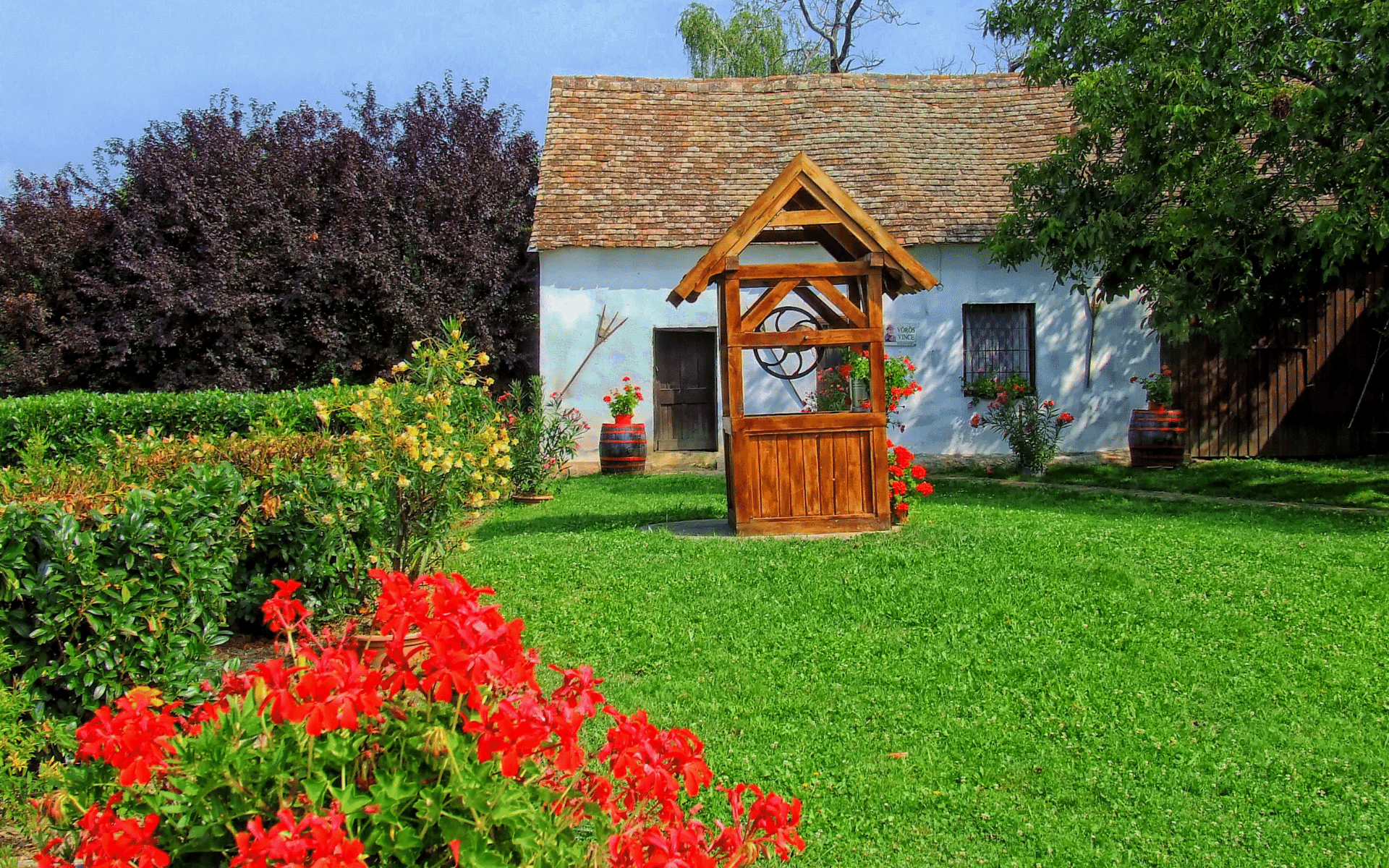

It is official, we are now in spring; we can now all enjoy those longer days and better weather, and

watch whilst flowers bloom and trees blossom. It is the season where Mother Nature loves to show

off her splendour, and when it comes to selling your home, you need to be doing the same. Spring is

the best time of year to sell your home, and according to Rightmove, this is because of record prices,

the imbalance between demand and supply as well as the prospect of finding a buyer the first week

your home is on the market. And whilst your focus may be directly internally, we want to make sure

you understand why you should not neglect your garden when selling your home this Spring in

Surrey.

It’s a blooming market

“Those who weren’t ready to take advantage of last year’s rush now have another chance to get on

the market while these conditions last”, Tim Bannister, Rightmove’s Director of Property Data

comments. Anyone selling their home wants to ensure they a maximising their sale in every way –

who wouldn’t want to miss an opportunity to add some value, and your garden is a hidden gem.

According to Good Move house experts, “Transforming your garden can be the most fruitful way of

adding value to your home, with a well-kept garden raising prices by around 20 per cent.” Although

many home owners understand the potential their garden holds can bring to the value of their

property, there are many that ignore this area when preparing their home for sale.

Lockdown goals

Lockdown saw many of us turning our time to our gardens: bars were erected, decking built and

outbuildings constructed creating havens for us to enjoy whilst the strange times we were living in

passed us by. Potential buyers, too, wish to imagine themselves spending time in a garden that is

ready to enjoy, not one that has a wild side and needs a lot of work to restore. Your garden is an

extension of your home, and should the sun be shining, buyers love to imagine themselves al fresco

dining or enjoying a tipple or two. Don’t put barriers in their way by making them struggle to see

what your garden has to offer – make it the dream they have been seeking not the jungle they wish

to forget.

It needs to be green

There is something very attractive about a healthy lawn, one glistening in shades of green without a

balding patch in sight. Yet we all know how much maintenance it takes to keep a lawn looking green

and healthy. For many of us, those perfect contrasting green lines of grass are something we aspire

to but never quite achieve. If your lawn looks like it has seen better days, it may be best to invest in

some new turf. It may feel like an unnecessary expense, but having your garden in the best possible

condition could add value to your home and, what’s more, help it to sell more quickly.

Just like new

It isn’t just your lawn that needs to look healthy and just like new; the winter months having taken a

toll on many a home’s exterior, especially with the storms we have had. Paint and stains have faded

on gates and fences, decking may have some slippery grime or peeling stain, weeds have been

springing up and some plants may have a survived for another season. Yes, there is work to be done,

but the benefits are certainly worth it. Put yourself in the shoes of a potential buyer: how would you

feel about seeing a garden in tip-top shape and full or colour, compared to one that has seen better

days? Your offer may reflect how you feel, so make sure that your buyers see the value your garden

brings to your home.

Bring the lifestyle to life

Adding some finishing touches to your garden for a viewing brings to life the lifestyle your home

offers to a potential buyer. A viewing is the opportunity for your property to transform into a home

for sale. You want that show home feel that is organised yet warm, welcoming and intoxicating.

A table and chairs is just that, but add a tray with a couple glasses and a bottle and suddenly your

buyers are seeing themselves sitting there on a warm spring evening. A wall seat may go unnoticed,

but a throw, a cushion and a book transforms it into a cosy space to while away an afternoon. No

matter the size or style of your garden, there are little touches you can add to bring your space to

life. You don’t need to go overboard, just a couple here and there is enough to get a buyer’s mind

starting to imagine living there.

It deserves it

Give your garden the spring clean it deserves, and you are putting your home in the best position for

selling in this busy spring season. For more advice on how to prepare your Surrey home for

sale, call a member of our sales team on 01932 221331.

- Details

- Hits: 2784

Selling your home in Surrey? Start with sustainable decluttering

When you open that door to your first home, or your next home, you never know how your life will

change during your time there. One thing we know for certain is that inevitable collection of stuff

that starts to fill every drawer, cupboard and room in your home. When you decide to place your

home on the market a simple dust and vacuum is not going to be enough; one of the first things you

need to do is to get rid of your clutter. The quickest way may be to bin everything you no longer

want or need. As easy as this may be, it isn’t good for the environment. This is why, when you

decide to sell your home in Surrey, you should start with sustainable decluttering.

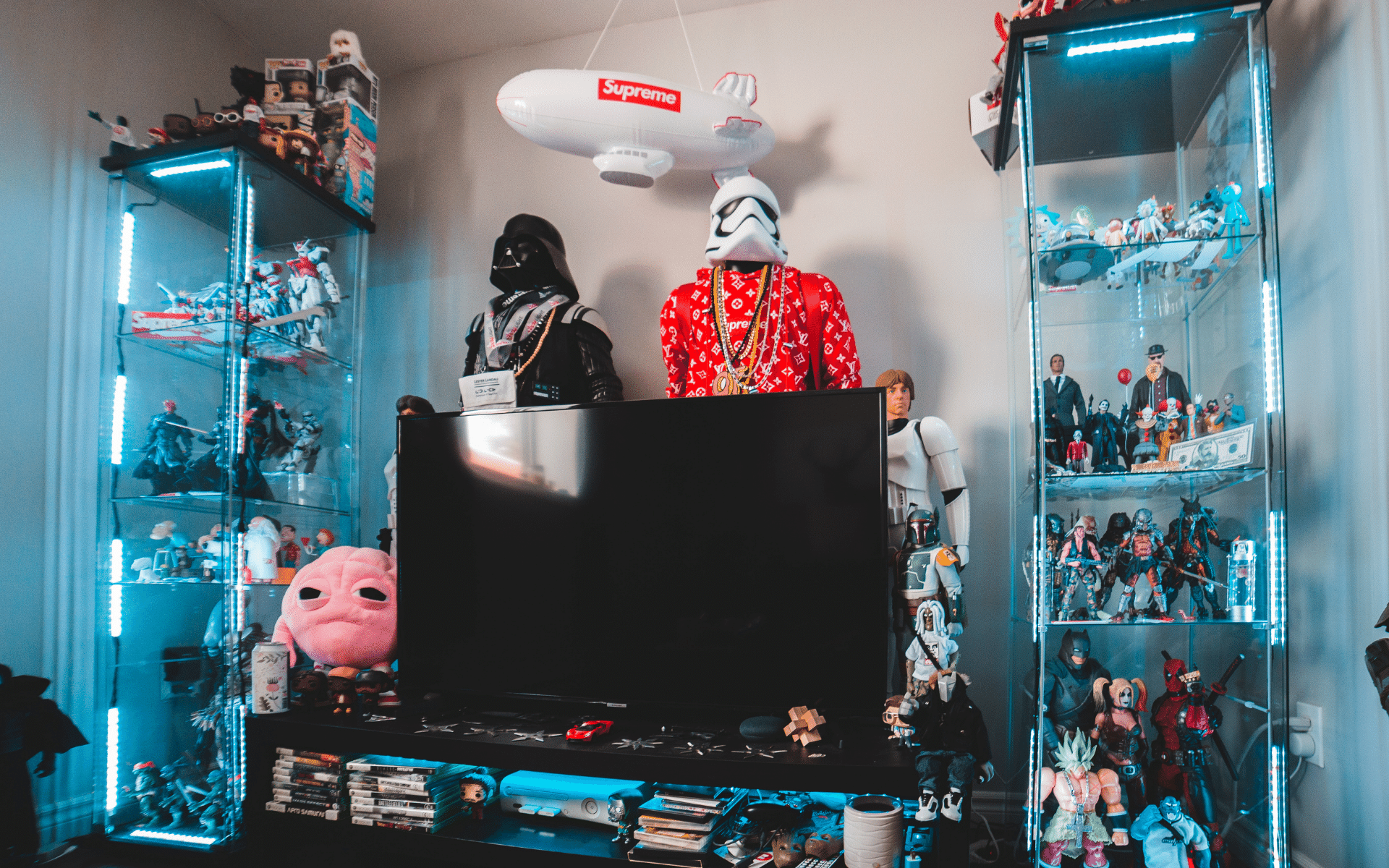

Why do I need to declutter?

There are many reasons why you should declutter your home when preparing it for sale. When

potential buyers view a home they want to be able to imagine themselves living there. If your house

is filled with numerous collections or bursting to the brim with personal mementos, all a buyer will

see is you and your family. Personal items can also make a buyer lose focus – when they are

intrigued by you they are failing to see how they can make your property theirs.

A full or disorganised room will make the space feel smaller, and one thing all buyers are looking for

is space. Clutter is space sucking, and instead of seeing the true possibilities a room holds, potential

buyers will be struggling to see how they will fit in. Marketing your home with beautiful images is

certainly going to catch a buyer’s eye, but an image of a home in need of decluttering will just be

ignored, and this is the last thing you want when selling your home.

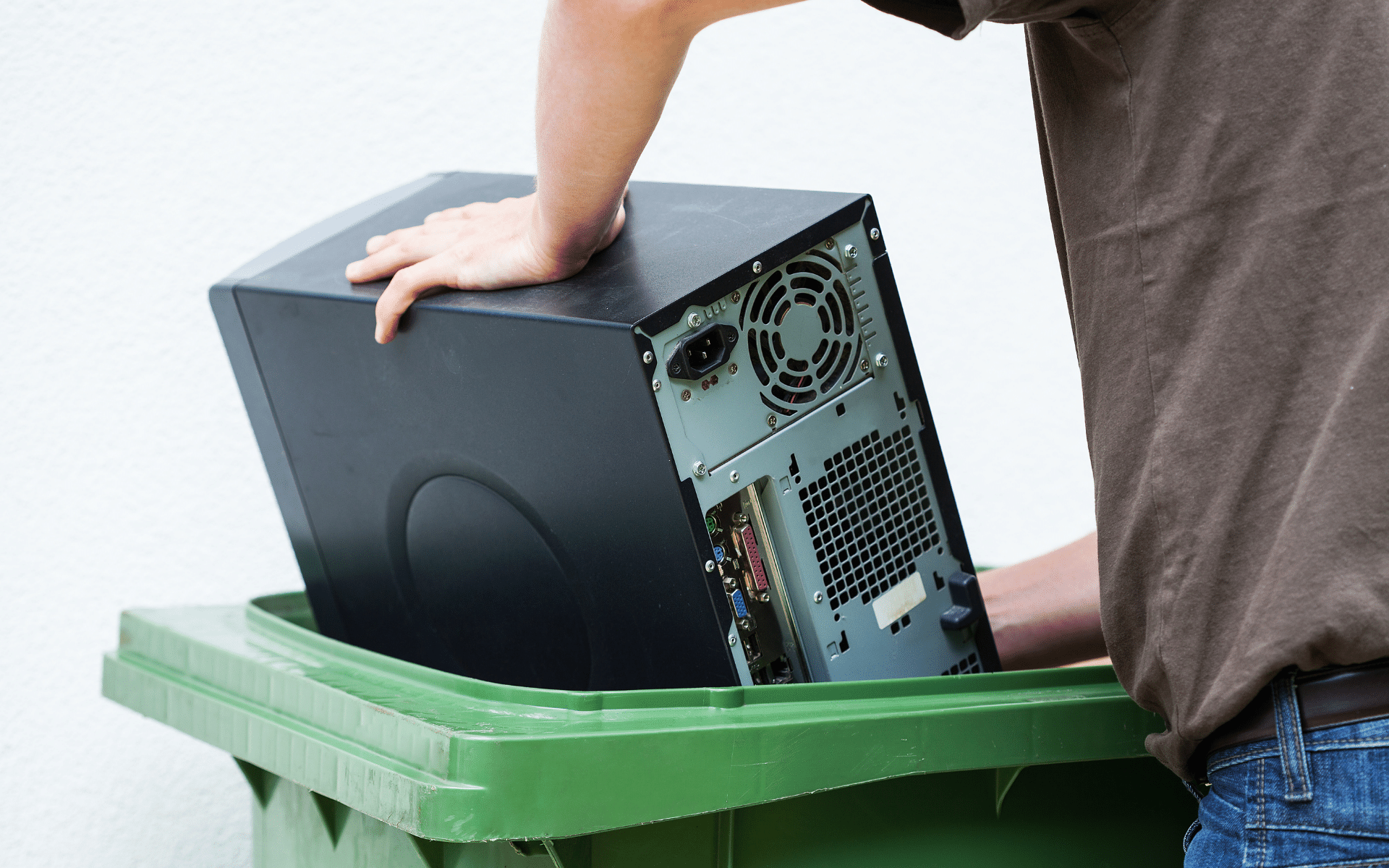

Start with electronic waste

We are positive that if you start looking through drawers, the back of cupboards and in your garage

you will no doubt find an array of electronic devices from old mobile phones, televisions, printers,

used printer cartridges and game consoles. Separate the electronics you find: those that work and

those that are broken and could possibly be used for parts. There are many charities looking for electronics which they refurbish and donate to those who are digitally excluded. Should you be

looking to dispose of your broken devices, search your council website for the correct way to do so.

At James Neave, we would suggest this be your last resort, as you may find that even parts can

be useful to someone rather than going into landfill.

Have those good intentions gone?

January is now behind us and that New Year’s resolution to get fit and healthy could mean that you

have some unused sporting equipment gathering dust in your home. Many of these pieces of

equipment are big; they can take up so much space making the room feel a lot smaller than it

actually is. Be proactive and honest, if you’re not using it then sell it or donate it to someone who

will really appreciate it.

The ‘Just-in-case’ curse

Time to get to your clothes, and we guarantee that you will have items in your wardrobe that you

have kept ‘just in case’. It is time to be realistic – do you want all those clothes cluttering up your

new wardrobe and still never being warn? Empty your wardrobe and drawers and get tough; only

keep those clothes that fit, you love, and you actually wear.

There may be some items that really have seen better days, but there will be many which are in

excellent condition and perfect to donate to a local charity. You may look at trying to sell some on

Facebook Marketplace to make a few extra pennies – ideal to help you purchase a little something

for your new wardrobe.

Hard to part with

It is funny how things like books, DVDs, and albums can be hard to part with; many people are mini-

collectors and have more books on their shelves than they are likely to read. If you are a book lover,

of course keep those that you love, are on your to-be-read pile or are hard to replace. Go through

your entire collection and, again, it is time to make some tough decisions, or pack them away ready

to decorate your new home.

Family photos are extremely personal; pack these away whilst your home is on the market, this

again will help potential buyers to see themselves, not you, living there. Artwork is subjective, what

someone may love, others could loathe. If you think the art in a room is distracting it may be worth

removing it, even if it is only for viewings, so a buyers eyes are focused on what is important.

Sustainable move

We all have a responsibility to do our bit to help the environment, and we hope we have given you

some ideas on how to get your home ready for sale in a sustainable way. Decluttering is an essential

process for preparing your home for sale, and helps to give buyers the best experience when viewing

your home.

If you’re thinking of selling your home in Surrey and want advice on the best way to

prepare your property for maximum impact, contact our team on 01932 221331.

- Details

- Hits: 2518

What home buyers in Surrey can learn from online dating this Valentine’s Day

All those who have ventured into the world of online dating will know what an emotional roller coaster it can be. From an online profile, you make decisions on what you see, and as a result you choose to slide right or left. Making such judgements based on a what is portrayed is what you do when you’re looking for a home in Surrey. As online dating is more the norm these days, you have, no doubt, picked up some knowledge to help ensure the date you pick has a higher chance of being successful. These tools can also be used when looking for a property, which is why we believe home buyers can learn a lot from online dating this Valentine’s Day.

You can only tell so much from a photo

Whether it is online dating or social media, we are all guilty of posting photographs that depict our happy times, but rarely do we share our whole life. The photos that you choose for your online profile may have even had a filter added to enhance your appearance in some way. Have you ever turned up on a date and realised the person in front of you hardly resembles the person you had expected to meet?

Photographs do tell the story about a home, but they do not give you the full picture. The angle used can make a room look bigger or smaller, and as much as they are a marketing tool to grab your attention (just like a dating profile), the only way to truly know if you are the perfect match is to meet in person. Only when you are in a room can you know if you get the feeling that you could fall in love with the home you are standing in.

Do your research

In this day and age, it is essential to do your due diligence before you meet someone on a date: you want to make sure they are a real person, they are who they say they are, and Google becomes a necessary tool. The same can be said if you are looking for a new home. If you do not know the area the property is located in, personally and thoroughly, then do your research.

Start by looking at Street View so you can see what is in close proximity and also the condition of the neighbouring homes. You can then look at what other amenities are close by, such as coffee shops, stores, parks, places to walk your dog and everything else you enjoy doing. Remember, it isn’t just the property that needs to meet your requirements, ideally, you should also fall in love with where you live, too.

Get the facts as well as the images

You wouldn’t choose to go on a date with someone based on their photos alone, would you? It isn’t just how someone looks that will grab your attention, it is the details that are expressed in their written profile. Property descriptions, creatively written or lacking in content, can often give away details that images do not provide. They can inform you about rooms that are not photographed, and, frustratingly, as not all estate agents provide a floor plan with their listings, this is essential information. They can give clues to the area, a covenant that the building is subject to, if there is a right of way, and many other factual details that could sway your decision on whether to view a particular home or not.

Stop over thinking

Dating rules, does anyone actually understand when you should text, etc? Often, we can over analyse and question everything when it comes to internet dating to the point that we can take the enjoyment out of the process. Buying a property is a huge investment; you will have worked hard to raise the deposit and no doubt have been dreaming of what this home will look like. You will probably have to make a compromise or two along the way. It is great to ask us, as your estate agent, as many questions as you need to help you make a decision, but if you start to overanalyse you may find that you talk yourself out of that perfect home. Delaying putting in a offer could also see you lose out, especially in this current market in Surrey where buyers are aplenty and the number of properties for sale remains low.

Trust your gut!

You know very quickly if you and your date click or not, and research across the world has shown that it takes around 8 seconds to know if a home has stolen your heart or not. Remember not to just go solely on looks, it has to work for you in practical ways too. If you’re looking for a home to love this Valentine’s Day, at James Neave we hold the key to your heart.

To begin your home search today, call our sales team on 01932 221331.

- Details

- Hits: 2525

What does 2022 hold for you and your home in Surrey?

With every new year we have expectations of the year ahead; we always hope it is better than the last, and during a pandemic we wish that even more. Yet, as we know, there will be a few challenges for us this year as economists predict that our living standards will deteriorate . But there is also some light too, whether you’re looking to move home or stay put, it is always good to be prepared. Our team at James Neave have come together to give you an insight into what 2022 holds for you and your home in Surrey.

Base rate increase

If you didn’t have your eye on the ball last month, you may have missed the Bank of England’s surprise decision to increase the base rate to 0.25% from 0.1%, after the Monetary Policy Committee approved the decision. This is the first rise in more than three years. How does this affect you? The central bank uses the base rate to charge other lenders and banks when they borrow money, which in turn influences the rate at which you borrow and savers earn. This may only equate to a relatively small increase in your monthly payments for those with a variable rate mortgage, and if you have a fixed rate deal you can breath a sigh of relief as you are protected for now. Should you be looking to secure a new mortgage you will find that the rates are higher.

Buying a home

If you were looking for a home over the last 18 months you will know you have been caught up in a frenzy where available properties have been few and buyers many. This lack of supply over demand saw house prises rise and many buyers missing out on properties and even not even getting a viewing. We predict that this year will see things starting to balance out a bit. We have already seen an increase in requests for valuations from sellers in Surrey. It’s not just us that have seen an increase in valuation requests, Rightmove have also stated that they have seen a 19% increase in requests compared with this time last year. We’re excited with the range of homes that we predict will be coming on to the market in the new few weeks.

Selling your home

Last year was most certainly a sellers’ market but we do believe this year we will see more stability in the Surrey housing market, although we still expect it to be strong for sellers. "If you do decide to sell your home in the new year, your chances of finding a buyer are very high, as we’re still seeing huge levels of buyer demand, and not enough homes available to buy”, according to Rightmove's property expert Tim Bannister. We have many buyers registered with us at James Neave who are still looking for their first or next home. If you’re curious about the current value of your property or thinking about moving, give our team a call.

Make your finances a priority

Regardless of what ups and downs this new year will bring, you have the power to get yourself in a healthy position financially. We can all make small changes here are there that can help towards a deposit, a new bathroom, or even simply improving your quality of life. When is the last time you did a rigorous assessment of your outgoings? You will be surprised by the number of people who don’t realise they are paying small subscriptions out for one thing or another every month. Be frugal about shopping and more so about what you waste – every positive change you make at home will have an impact one way or another to your monthly finances.

What is in your 2022?

New year plans and resolutions can often change or be put on the back burner as life takes over, but whatever you do this year, always keep a watchful eye on what’s happening financially around you. Placing yourself in a financially savvy position will only be of benefit when you decide it is time to move home in Surrey, and when that time comes, we will make sure that your money is invested wisely.